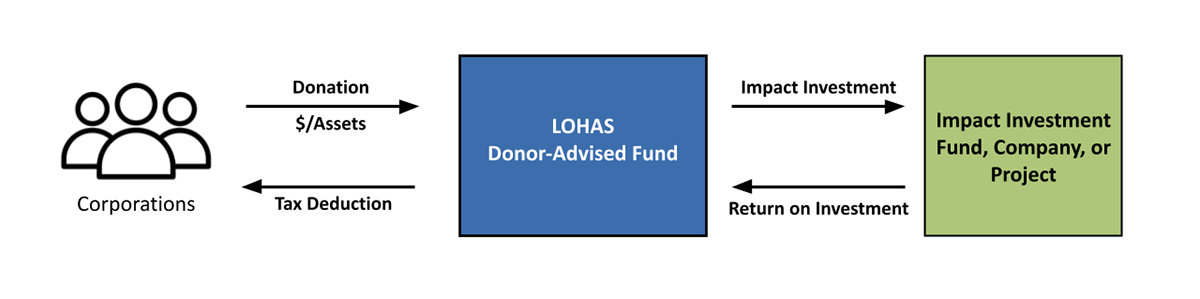

For corporations seeking to make social or environmental impact investments and tell a better ESG story to bolster their brand and align better with customer and stakeholder demands, LOHAS donor-advised funds (“DAFs”) provide greater flexibility than a corporate foundation. At LOHAS, DAFs have been retooled to be impact investment vehicles, and the LOHAS team can help align a company’s strategic goals with impact investment opportunities.

UNLOCKING THE INVESTMENT POTENTIAL OF DONOR-ADVISED FUNDS

Unlike most DAF sponsors that limit donors to making grants to nonprofits, or the handful of DAF sponsors that permit donors to do impact investing with their DAFs but restrict those activities with investment minimums or a pre-determined list of approved recipients, LOHAS has unlocked the world of DAF impact investing by encouraging corporate donors to invest in what they want, structured as desired, and in the amounts they deem appropriate to achieve their strategic social and environmental impact goals.

IS A LOHAS DONOR-ADVISED FUND A GOOD FIT FOR YOUR COMPANY?

Q: Are your social and environmental impact interests limited to a single charity?

A: Then, No, use the DAF of your preferred nonprofit and allow all of your donations to flow to that specific charity.

Q: Do you recognize the power of social enterprise to change the world and want to use donated capital to orchestrate that change by investing your DAF funds in the impactful companies, funds, projects, and productions of your choice?

A: Then, Yes, a LOHAS DAF is for you.

Q: Have you wanted to do more impact investing? Are you uncertain about how and where to invest? Are you interested in risk-free donated capital as a way to test the impact investment waters?

A: Then, Yes, a LOHAS DAF is for you.

Q: Already have a Donor-Advised Fund (but want the impact investing handcuffs removed)?

A: LET US SHOW YOU HOW TO TRANSFER YOUR DAF FUNDS.

Q: Interested in opening a Donor-Advised Fund and making your own impact investments?

A: LET’S GET YOUR DAF SET UP TODAY.

HOW DOES LOHAS HELP?

The LOHAS team of professionals provide:

- Hands-on support setting up or transferring your DAF

- Guidance in establishing your impact investing strategy

- Deal sourcing and analysis to satisfy investment goals

- Ongoing performance reporting and investment support

- Fees paid only from DAF funds

LOHAS actively advises donors about impact investing and helps enable investment strategies that are designed to make a measurable and sustainable difference. LOHAS supports INDIVIDUALS AND FAMILIES as well as Corporations.

LOHAS DAF ADVANTAGES

Whether your company is looking to enhance your brand, align better with stakeholder demands, or achieve strategic goals by supporting select impactful ventures, a LOHAS donor-advised fund has many advantages:

- An immediate tax deduction within the year the contribution is made

- No distribution minimums, fewer tax and reporting requirements, and a greater degree of privacy than is available through a corporate foundation

- The ability to invest your DAF funds into the socially or environmentally impactful companies, funds, projects, or productions you select

- A way to use risk-free donated capital to explore the world of impact investing

Ready to explore impact investment opportunities or looking for support as you craft your DAF-enabled impact investing strategy? LET US HELP!