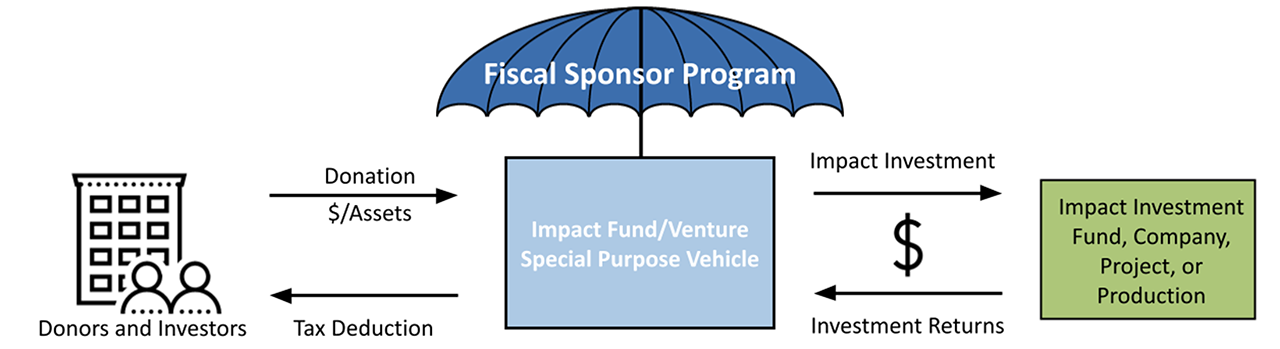

Socially or environmentally impactful funds and ventures have another path for raising capital and engaging a broader group of financial supporters. Through the LOHAS Fiscal Sponsor Program (“FSP”), funds and companies may immediately take in investment capital via tax-attractive donations and split-interest investments from a variety of contributors while also ensuring that the expanded fundraising story is developed and shared in the most compelling manner.

A thought leader in the impact investing strategic advisory arena, LOHAS specializes in supporting the needs of socially and environmentally impactful funds and other ventures, providing outbound support to ensure that the specific opportunity is conveyed by fundraisers in the most compelling manner (digitally as well as directly). LOHAS works with professional fundraisers to champion alternative FSP structures and strategies to accelerate and amplify the flow of capital to socially and environmentally impactful ventures.

LOHAS DELIVERS A SIMPLE SOLUTION:

- The FSP fund is available to receive donations/investments upon inception (activation within a day!)

- As capital is received, donors receive immediate, maximum tax deductions (and documentation)

- The FSP fund makes direct investments into the impact venture you select

- Ongoing accounting and reporting are provided on capital received and disbursed

- The FSP fund not only further supports the impact venture but also establishes a platform for ongoing, sustained investment always dedicated to its mission

Attract more capital while delivering meaningful financial advantages to your supporters and achieving greater social impact for your cause. APPLY TO SET UP YOUR LOHAS FSP TODAY!

WHY USE THE LOHAS FISCAL SPONSOR PROGRAM

There are many fiscal sponsors in the market, but they typically do not specialize in supporting the needs of socially and environmentally impactful ventures. Other fiscal sponsors may be limited in the complexity that they can support (from multiple types of donors and investors utilizing various donation and investment structures) and generally provide no outbound support to ensure that the opportunity is conveyed by fundraisers in the most compelling manner (digitally as well as directly).

Unique advantages of establishing a LOHAS FSP include:

- Cost: Not only are fees based primarily on assets under management (“AUM”), but those fees are also below the market rate despite offering substantially more services and support as compared to typical fiscal sponsors.

- Fundraising Flexibility: A LOHAS FSP accepts cash contributions from individuals and companies; grants and distributions from donor-advised funds, foundations, and charitable trusts; and anything with established or appraisable value, including cryptocurrency, real estate, stocks, bonds, privately held business interests, and collectible art.

- Simplicity and Immediacy: Even those who recognize the benefits of a nonprofit or foundation structure do not usually want to manage the complexities of running such an organization (including ensuring IRS compliance), nor do they want to wait to obtain 501 (c)(3) charity status. LOHAS, in partnership with its FSP administrator, removes those concerns and can be operationally ready to receive funds from its inception.

- Front-Office and Back-Office Support: LOHAS helps fund managers with “front office” messaging and donor/investor education and engagement needs while LOHAS’ FSP administration partner manages “back office” requirements and program management, including receipts and disbursement of all funds, issuance of tax documentation, state and federal compliance, accounting, and reporting.

AMPLIFY YOUR FUNDRAISING STORY

For mission-driven companies or socially or environmentally impactful projects raising funds, a LOHAS FSP provides options to prospective investors, allowing them to invest as well as donate tax-deductible capital. This unique offering also signals to investors the relationship between your venture and the FSP’s cause (as most companies are not supported by a public charity) while also giving those investors the opportunity to align their philanthropic portfolios with their investment portfolios.

With a LOHAS FSP, fundraisers have a creative option to suit the needs of multiple groups:

1. Parties that, despite their alignment with and support for the venture’s cause, cannot (or will not) make a direct investment

- Investors that do not traditionally make “impact” investments or for which the company or project does not fit within pre-set portfolio parameters

- Parties that are clearly committed to the venture’s cause, but which are not structurally prepared to make a direct investment

Not an Issue Just for Individual or Family Investors: Despite public initiatives or announcements, corporate silos between investment, CSR, and ERGs often limit the flexibility to invest in impact ventures, while foundations are typically better structured to grant funds rather than invest capital. Nonetheless, both corporations and foundations may recognize the value of aligning with a social enterprise and the financial benefit of being able to generate returns for sustained reinvestment in the cause.

2. Parties that are making an investment in the company or project, but which also have…

- Donated capital they can contribute from an existing family foundation or donor-advised fund

- A desire to generate new tax offsets from a direct donation in the venture’s FSP

Put another tool in your fundraising toolbox. APPLY TO SET UP YOUR LOHAS FSP TODAY!